Everything about Scj Cooper Realtors

Top Guidelines Of Scj Cooper Realtors

Table of Contents5 Simple Techniques For Scj Cooper RealtorsUnknown Facts About Scj Cooper RealtorsRumored Buzz on Scj Cooper RealtorsSome Known Factual Statements About Scj Cooper Realtors

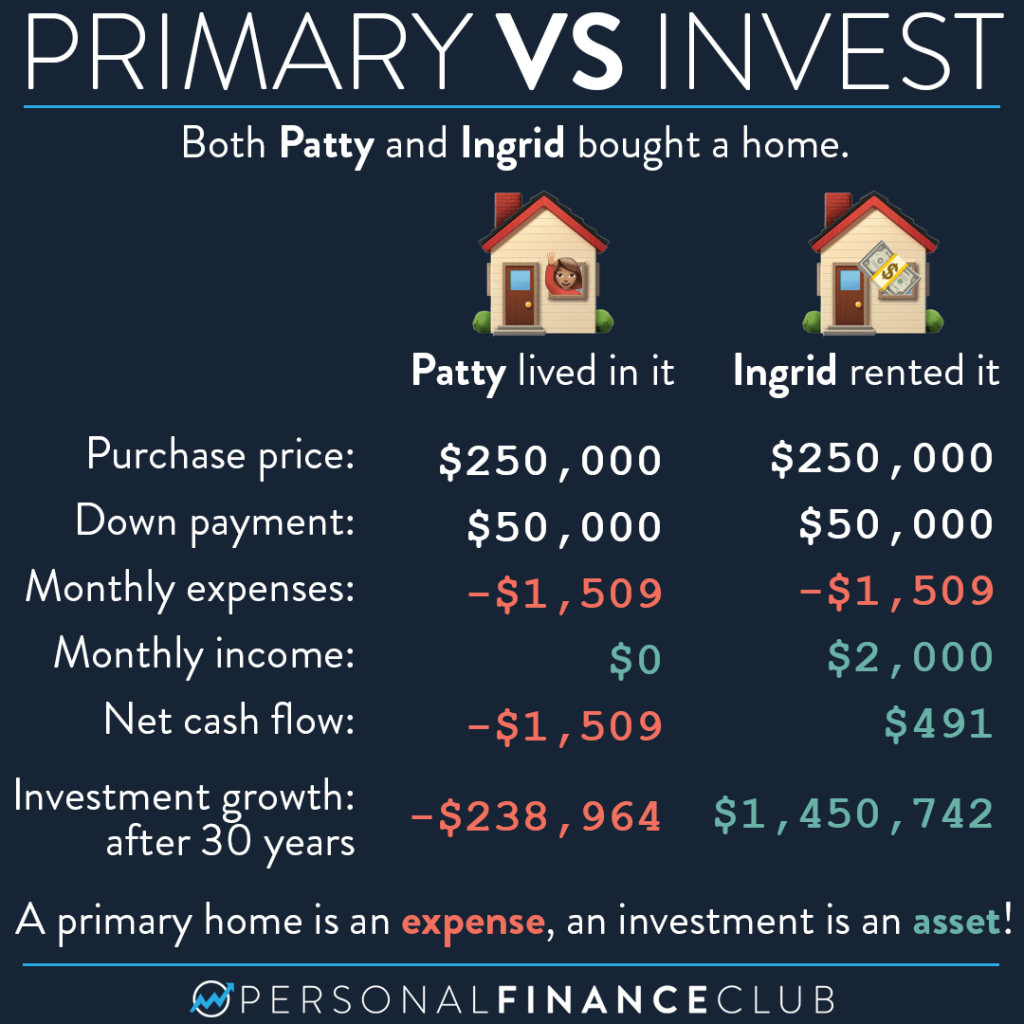

For comparison, Wealthfront's typical profile gained simply under 8% web of charges over the past 8 years. As well as the Wealthfront return is even more tax obligation efficient than the return you would receive on realty as a result of the method rewards on your Wealthfront profile are strained and our tax-loss harvesting - scj cooper realtors.1% return, you need to have a nose for the neighborhoods that are likely to appreciate most rapidly and/or find an extremely mispriced home to get (into which you can spend a tiny amount of cash as well as upgrade into something that can command a much greater lease also much better if you can do the work yourself, but you need to ensure you are being sufficiently made up for that time).

And we're speaking about individuals that have huge personnels to aid them discover the optimal home and make renovations. scj cooper realtors. It's much better to expand your investments You need to think of buying an individual property similarly you ought to consider a financial investment in a private stock: as a huge threat.

The idea of trying to pick the "right" individual home is appealing, specifically when you think you can get an excellent deal or purchase it with a whole lot of utilize. That approach can function well in an up market. However, 2008 instructed everyone concerning the risks of an undiversified realty portfolio, and also reminded us that take advantage of can function both means. scj cooper realtors.

Our Scj Cooper Realtors Diaries

Liquidity issues The last major argument against owning financial investment homes is liquidity. Unlike a realty index fund, you can not sell your residential property whenever you want. It can be difficult to forecast how much time it will take for a house to sell (and it frequently seems like the extra eager you are to market, the longer it takes).

Trying to earn 3% to 5% even more than you would on your index fund is nearly difficult except for a handful of actual estate private equity capitalists who draw in the ideal and the brightest to do absolutely nothing but focus on outmatching the market., you must not treat your home as an investment, so you do not have to restrict your equity in it to 10% of your liquid web well worth).

If you own a residential or commercial property that rents for much less than your carrying expense, then I would highly prompt you to take into consideration selling the property and rather spend in a varied portfolio of Homepage affordable index funds.

Some individuals pick to purchase a property to lease out on a long-lasting basis, while others go for short-term rentals for visitors and also organization tourists. From houses, single-family homes, and also penthouses to industrial offices as well as retail rooms, the city has a large variety of residential or commercial properties for budding investors.

The Of Scj Cooper Realtors

Is Las Vegas genuine estate a great financial investment? That's why the city is continually ending up being a top genuine estate financial investment location.

Las Vegas is known for its business conventions and profession programs that it organizes annually. These bring in company travelers and entrepreneurs from all walks of life that, once more, will certainly be seeking somewhere to stay. Having a property residential property in the location will be useful for them as well as make returns for you.

You can prepare for a consistent stream of people looking to lease out purchase, even your Las Las vega real estate financial investment. What to Try to find in a Great read this Investment Property, Purchasing real estate is a significant life decision. To establish if such a financial investment benefits you, be sure to take into consideration these essential factors.

Some Ideas on Scj Cooper Realtors You Need To Know

Seek advice from the city government or agencies in fee of city planning and zoning. They can provide you a concept of what remains in shop in the location, so you can much better analyze if this is review a good investment. 3. Building Worth, Recognizing the estimated value of the residential or commercial property ahead of time helps you choose whether or not the investment is worth it.